Take control of your cash flow

Fast and affordable finance, on-demand.

Maximize the cash you need to grow your business

Our financial products

Boost buying power and delay vendor payments

Accounts payable finance

Buy when opportunity strikes

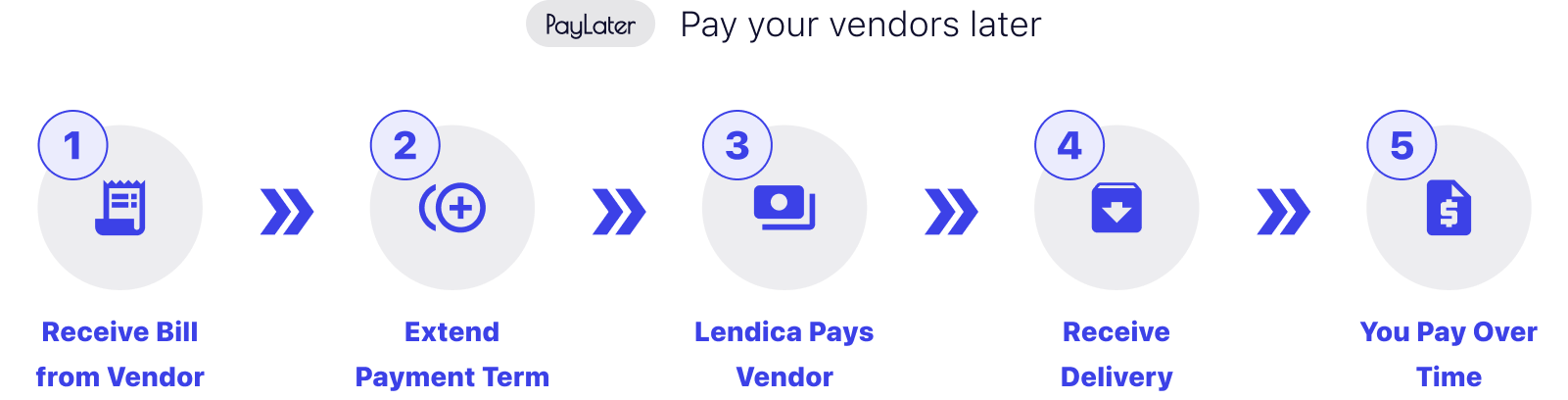

PayLater is your tool to take control of your accounts payable.

PayLater Rates

Advance rate

70% - 100%

Processing fee

1%

Term length

2 - 8 weeks

Financing fees

1 - 2.5% / mo

What can you do with PayLater?

Improve cash flow

When you delay the payment of bills, you have more cash to spend on operations.

More buying power

Take advantages of quantity discounts when you purchase in bulk to expand margins.

Speed up customer collection and offer flexible terms

Accounts receivable finance

Get paid upfront on your sales invoices

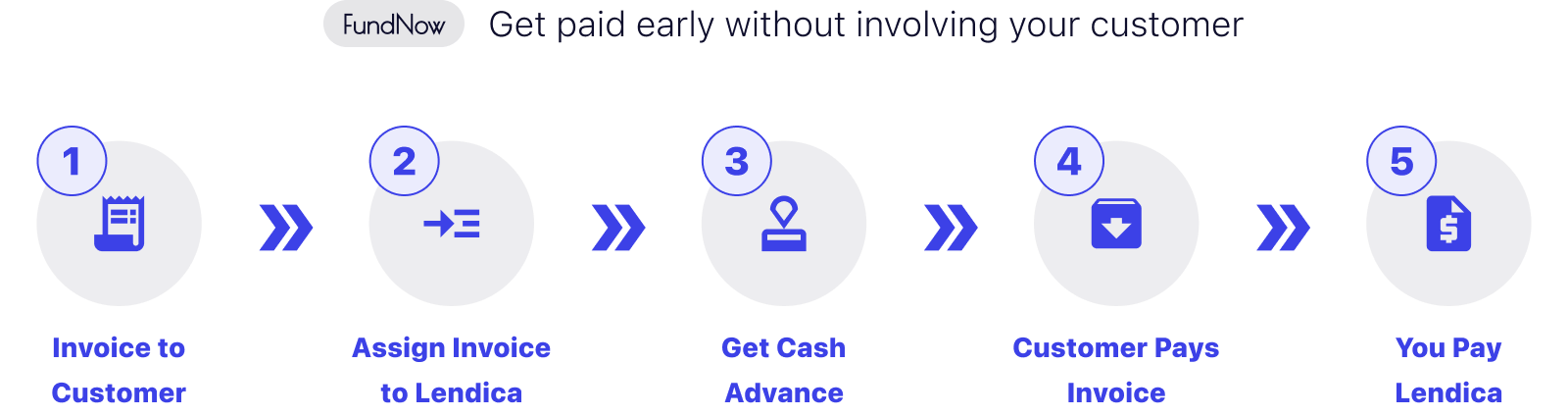

FundNow is your tool to take control of your accounts receivable.

FundNow Rates

Advance rate

70% - 90%

Processing fee

1%

Term length

30 - 60 days

Financing fees

1 - 2.5% / mo

What can you do with FundNow?

Improve cash flow

When you speed up collection from your customers, you have more cash for operations.

Win enterprise accounts

Match or beat your competitors net seller terms without stalling out your cash flow.

Add PayLater to the bills you send to customers

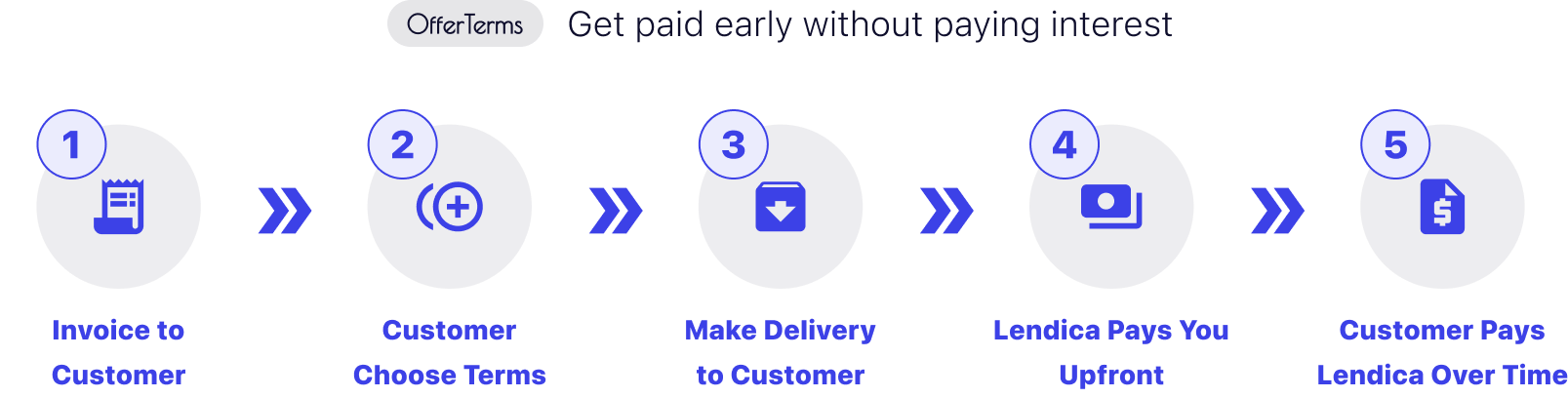

OfferTerms gets you paid on delivery while still offering terms.

OfferTerms Rates

Advance rate

70% - 90%

Processing fee

1%

Term length

30 - 60 days

Financing fees

1 - 2.5% / mo

What can you do with OfferTerms?

Improve cash flow

Get paid immediately on each invoice while still allowing customers to pay over time.

Boost your basket sizes

Let your customers take advantage of savings opportunities such as discounts on bulk purchases without taking on collection risk.

Use non-dilutive capital to scale your empire

Revenue-based finance

Draw fast and affordable cash for big purchases and growth projects

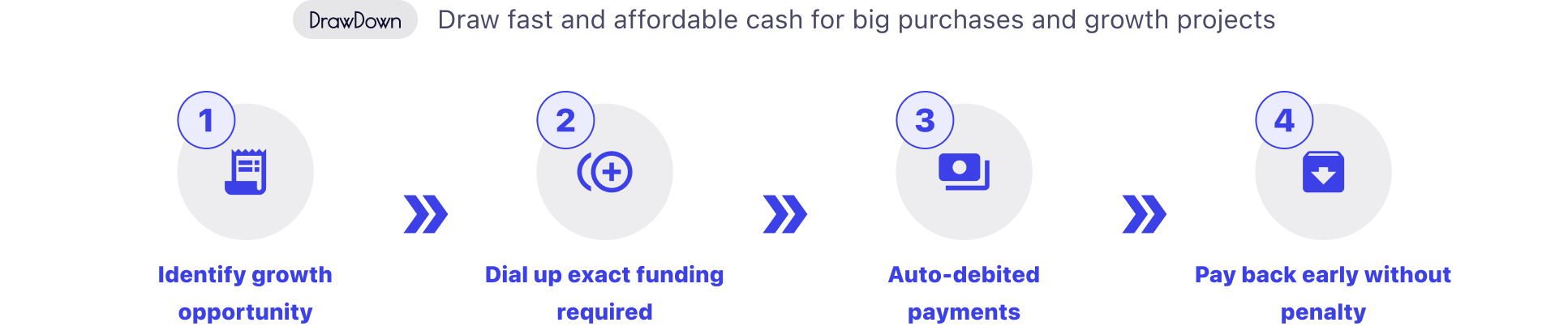

DrawDown is your tool to take control of your working capital.

DrawDown Rates

Processing fee

5%

Term length

up to 182 days

Financing fees

1.5 - 3% / mo

What can you do with DrawDown?

Improve cash flow

Draw affordable capital to keep cash on hand and invest in big purchases.

Scale without dilution

Preserve valuable equity without comprising on growth capital.